Owning your own home is life life-changing step and for this purpose securing the right mortgage is very important. Whereas the loan should be according to your budget and goals. For this purpose mortgage loan calculators are essential tools that can provide you clarity and empower you to make perfect decisions. So to make this process very simple we are writing this article to explore and provide you with information about what is loan calculator, how it works, and why a loan calculator is important for you. So keep reading the article.

What Is a Mortgage Loan Calculator?

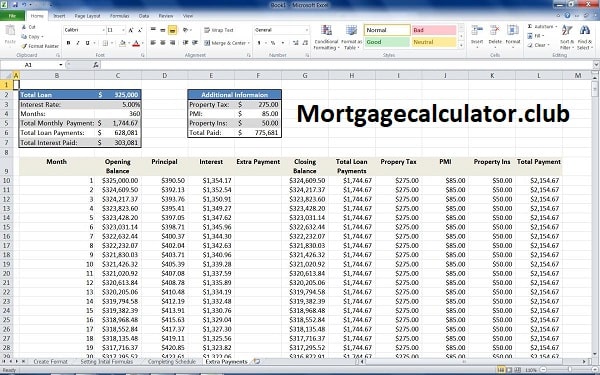

It is an online tool that help individual homebuyers and current homeowners to calculate and understand different financial factors that are involved with their mortgage. You can use the tool to estimate your monthly mortgage and also analyze various loan scenarios to make an accurate decision. You can use a loan calculator on our website and also these calculators are available on many other websites.

How does the mortgage loan calculator work?

The mortgage calculator works by considering many factors which are available below.

Principal amount or loan amount

The calculator considers the loan amount that you are borrowing from a bank or any other financial institution. You can also use the calculator for refinancing the existing mortgage.

Interest rate calculation

It also considers the annual interest rate which is expressed in the percentage that the mortgage lender will charge on the loan.

Loan term

This is also the main factor that tells the number of years you will repay the loan amount.

Down payment

You can calculate the down payment which is the initial amount that you have to pay against the mortgage you are getting.

Insurance and property taxes

Many online calculators allow users to estimate their property taxes and homeowners insurance for their area.

After using all these inputs the mortgage loan calculator will provide a formula to determine your monthly payment. This payment will also include the principal amount and interest rate. You can also see many other things like the total cost of the loan and a breakdown of how each monthly payment is allocated between interest and principal.

Features of Mortgage loan calculator

Below are some prominent features of the calculator.

Compare loans

You can easily compare different loans and explore other options like fixed-rate mortgages, adjustable-rate mortgages, and interest rate differences from various lenders.

Affordability analysis

By using this feature you can easily assess your financial condition for homeownership. You can easily determine if you can afford the loan or not by considering your income and expenses.

Do budget planning

The tool also helps you in budget planning. It will provide you with a clear picture of your monthly expenses and you can also use it for property taxes, private insurance, and homeowners insurance.

Calculate your closing cost

You can put your down payment in the tool and can estimate your closing cost. In this way, you can see your upfront expenses.

FAQS of mortgage loan calculator

Below are some common FAQS.

Is the mortgage loan calculator accurate?

Yes, it is a perfect tool to calculate your mortgage loan and provide an accurate figure.

Why use a mortgage calculator?

You can use the calculator for many purposes but the main purpose of the calculator is to translate a home price or loan amount into the corresponding monthly payment.

Is the monthly mortgage fixed or variable?

Fixed-rate mortgages have payments that do not change during the mortgage term.

Conclusion

The mortgage loan calculator is the best utility tool that makes sure to empower individuals to move on the journey of the complex real estate world with confidence. You can use the tool for many purposes like calculating monthly payments, assessing affordability, making budgets, and making informed decisions.